Laramie Estate Planning Lawyer

Your Laramie Estate Planning Lawyer

Many people think that estate planning is only for wealthy and older people but to the contrary, there are many things a Laramie, WY estate planning lawyer can do to help people of all ages and socioeconomic levels to protect the assets they want passed on to specific people or entities, as well as to make sure that their healthcare wishes are carried out. The skilled and compassionate team at Davis & Johnson Law Office has 50+ years of combined experience helping Wyomingites with estate planning, wills, trusts, and probate. Contact us today to see how we can start helping you to have peace of mind knowing that the future of your assets and healthcare wishes are secure.

Estate Planning And How It Helps

Estate planning involves making plans for who you want to inherit your money, assets, and property, and legally documenting your healthcare wishes for yourself in the event you are unable to make decisions for yourself. It allows you to appoint the person or people who will oversee and make sure that your wishes are enforced.

Even though many people do not want to think of their own death and worry that planning their estate is a way of saying that they are ready to go, most people feel a big sense of relief knowing not only that they have laid out their, just in case plans, as well as their wishes for where their wealth will go. Having the weight of doing this finally lifted off your shoulders may actually allow you to be more present in the here and now and allow you to enjoy your life more than ever.

Estate planning makes your and your loved ones’ lives easier. You know that your wishes will be carried out and your family or other heirs will not be subjected to fighting over who wants what or how things should be organized once you are gone. With the help of a good Laramie estate planning lawyer, you may also be able to set things up so that your heirs do not have to go through probate which will save them time and money.

Avoiding Probate With Estate Planning

Some things allow heirs to avoid going through probate in Wyoming. One is a small estate affidavit that allows heirs to transfer personal property without going through probate. As of 2025, the maximum value for using a small estate affidavit in Wyoming was $400,000. The most common estate planning tool to avoid probate is establishing a revocable living trust. A living trust is a document that is similar to a will, that allows a person to name a successor trustee to take over their affairs after they have passed. Assets such as life insurance policies, retirement accounts, and other accounts that have named beneficiaries, also avoid probate.

To learn more about estate planning and how it can help you, contact an experienced Laramie estate planning lawyer at Davis & Johnson Law Office today.

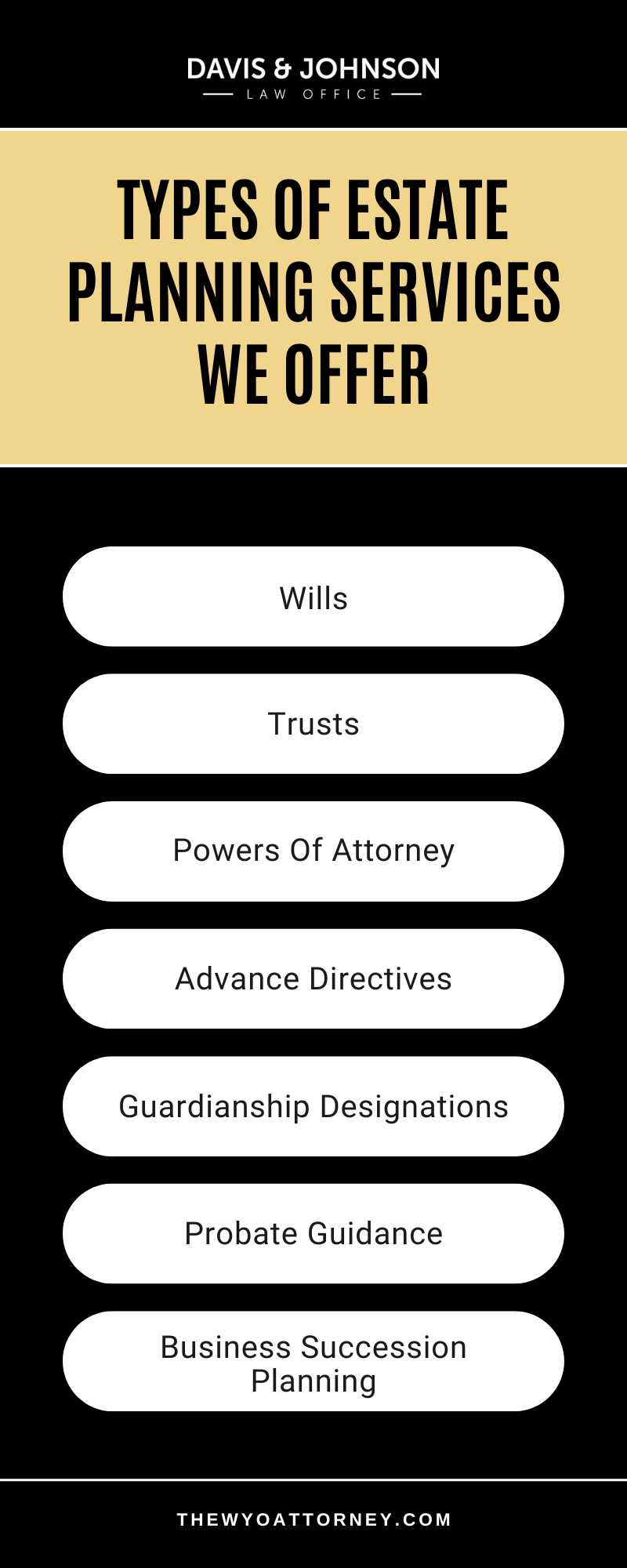

Types Of Estate Planning Services We Offer

Planning for the future isn’t always easy to think about, but having a clear, legally sound estate plan ensures peace of mind for you and your loved ones. An estate planning lawyer helps organize your wishes and protects your assets through a range of legal tools. Here are the most common types of services that a skilled Laramie, WY estate planning lawyer may provide. Davis & Johnson Law Office has lawyers who specialize in estate planning and would be more than happy to assist with whatever your estate planning needs are. Continue reading to learn about the different services provided.

Wills

A will outlines how your assets should be distributed after your death. It also allows you to name guardians for your minor children and an executor to manage your estate.

Trusts

Trusts are legal arrangements that allow a third party, or trustee, to hold and manage assets on behalf of beneficiaries. They can help avoid probate, reduce taxes, and provide specific instructions for how and when assets are distributed.

Powers Of Attorney

A power of attorney grants someone legal authority to act on your behalf if you’re unable to make decisions. This can cover finances, property, and legal matters, depending on the type created. An experienced Laramie, WY estate planning lawyer will be able to go into more detail about this for you.

Advance Directives

Also known as living wills, advance directives let you communicate your medical preferences in case you become incapacitated. They often go hand in hand with a healthcare power of attorney.

Guardianship Designations

If you have minor children or dependents with special needs, naming a guardian is essential. This ensures that your loved ones are cared for by someone you trust in the event of your death or incapacitation.

Probate Guidance

A Laramie, WY estate planning lawyer can also help your family navigate probate court after your passing. This includes filing paperwork, representing the estate, and distributing assets according to your will or state laws.

Business Succession Planning

If you own a business, you’ll want to include it in your estate plan. A lawyer can help you prepare for a smooth transition of leadership and ownership to ensure your business continues to operate as you intended.

Working with an estate planning lawyer can make all the difference when it comes to protecting your legacy. These legal tools aren’t just for the wealthy—they’re for anyone who wants to make sure their wishes are followed and their loved ones are protected. Davis & Johnson Law Office can help. Whether you’re just starting out or updating an old plan, professional guidance ensures every detail is covered with care. The lawyers at Davis & Johnson Law Office believe in using clear and consistent communication with our clients to ensure customer satisfaction – and so you know what you are getting from the services being used.

Types Of Estate Planning Services We Offer

Planning for the future is about more than just writing a will—it’s about ensuring your wishes are honored, your loved ones are protected, and your assets are distributed according to your intentions. A skilled Laramie, WY estate planning lawyer provides a wide range of services to make that happen. Davis & Johnson Law Office has offered legal services for over 50 years and offers extensive experience in this realm. Here are some of the most common estate planning services offered at the practice.

Drafting Wills

A legally sound will ensures that your property is distributed how you want it to be. It also allows you to name guardians for minor children and an executor to manage your estate.

Creating Trusts

Trusts can help avoid probate, manage assets for beneficiaries, and even protect wealth from certain taxes or creditors. Different types of trusts serve different purposes, depending on your goals.

Power Of Attorney

Establishing a durable power of attorney lets you choose someone to handle your financial matters if you become unable to do so. This ensures your bills, investments, and property are managed properly in a crisis.

Health Care Directives

Also known as a living will or advance directive, this document outlines your medical preferences and designates a trusted individual to make decisions if you’re incapacitated.

Probate And Estate Administration

A lawyer can assist loved ones after a person passes away by guiding them through the probate process and helping settle the estate in accordance with the law and the decedent’s wishes. A Laramie estate planning lawyer can also answer some of the most common questions about probate.

Tax Planning

Proper estate planning can help minimize estate and inheritance taxes. A lawyer can work with your financial team to structure your estate in a way that protects more of your wealth.

Business Succession Planning

If you own a business, having a plan for who will take over is essential. A Laramie estate planning lawyer can help outline your wishes and create a smooth transition strategy.

An estate plan gives you control over your future and peace of mind today. Whether you’re just getting started or updating an existing plan, an experienced estate planning lawyer can help ensure your documents are valid, comprehensive, and aligned with your personal goals. Davis & Johnson Law Office has lawyers working around the clock to communicate with you effectively. You need to reach out as soon as possible to ensure your family is protected.

What To Expect During Estate Planning

Estate planning can feel overwhelming at first, especially for individuals who have never taken the steps to organize their financial and personal affairs. Despite the perception that estate planning is only for the wealthy, it is valuable for anyone who wants to ensure that assets are protected, wishes are honored, and loved ones are supported in the future. Understanding what to expect during the process with a Laramie, WY estate planning lawyer can make it far easier and less intimidating. Davis & Johnson Law Office understands the process can be intimidating and that you may need some additional help throughout your estate planning journey. The firm has been delivering legal services for over 50 years and prioritizes good communication so that you can feel heard and have the kind of outcome with this that you want. Do not hesitate to reach out! Here are some of the things you may do while planning your estate.

Estate planning can feel overwhelming at first, especially for individuals who have never taken the steps to organize their financial and personal affairs. Despite the perception that estate planning is only for the wealthy, it is valuable for anyone who wants to ensure that assets are protected, wishes are honored, and loved ones are supported in the future. Understanding what to expect during the process with a Laramie, WY estate planning lawyer can make it far easier and less intimidating. Davis & Johnson Law Office understands the process can be intimidating and that you may need some additional help throughout your estate planning journey. The firm has been delivering legal services for over 50 years and prioritizes good communication so that you can feel heard and have the kind of outcome with this that you want. Do not hesitate to reach out! Here are some of the things you may do while planning your estate.

An Overview Of Personal And Financial Goals

The process typically begins with a clear discussion about overall goals. This includes identifying what matters most, such as providing for family members, planning for medical care, protecting assets, or preparing for the unexpected. A legal professional may ask questions about family structure, long-term priorities, and concerns to help create a customized plan.

A Review Of Assets And Beneficiaries

Next comes an evaluation of current assets. This may include real estate, bank accounts, retirement funds, investments, business interests, vehicles, and personal property. Understanding what is owned and how it is titled helps determine how those assets should be distributed. Identifying beneficiaries is an important step, ensuring that wishes are clearly stated and legally protected. Your Laramie estate planning attorney can assist with this.

Preparation Of Essential Documents

Several key documents are typically included in an estate plan. A last will and testament outlines how property should be distributed and designates guardians for minor children. A trust may also be created to manage assets more efficiently or protect them from probate. Powers of attorney for both financial and healthcare decisions ensure that trusted individuals can act on behalf of someone who becomes unable to make decisions independently. Advance healthcare directives outline medical preferences and guide loved ones during difficult times.

Consideration Of Tax Implications And Legal Requirements

A thoughtful estate plan takes into account federal and state laws, potential tax implications, and rules that govern asset distribution. This step may involve structuring the plan to reduce potential taxes, avoid unnecessary delays, and protect assets from risk. Skilled Laramie estate planning attorneys help ensure that documents are compliant and appropriately executed.

Discussion Of Long-Term Care And Future Planning

Estate planning often includes conversations about long-term care preferences, life insurance, and strategies to manage medical or residential expenses later in life. Considering these possibilities in advance can provide peace of mind and reduce stress for loved ones, especially during emergencies. An estate lawyer can even help with preventing creditors and lawsuits from dipping into the estate.

Signatures, Final Review, And Document Storage

Once all documents are prepared, they must be carefully reviewed and signed according to legal guidelines. Proper execution is essential to avoiding future disputes or complications. After signing, documents should be stored securely, with copies provided to designated individuals as appropriate.

Periodic Updates And Adjustments

Estate planning is not a one-time task. Life changes such as marriage, divorce, the birth of a child, or significant financial shifts often require updates. Reviewing documents regularly ensures that the plan stays aligned with current wishes and circumstances.

If estate planning is on your mind and you’re unsure where to begin, speaking with a legal professional can provide clarity and guidance. Davis & Johnson Law Office is here to help. Getting started now can help protect loved ones, secure assets, and bring peace of mind knowing that future decisions are clearly outlined and legally supported.

Laramie Estate Planning Infographic

Laramie Estate Planning Statistics

Despite widespread recognition of its importance, many Americans remain unprepared when it comes to estate planning. A comprehensive national survey found that a large majority (about 83 %) of U.S. adults say estate planning is important, yet far fewer actually complete the necessary legal steps. In fact, only around 31 % of Americans have a will, and just 11 % have a trust or similar estate planning document in place. This means that a majority of adults—about 55 %—have no estate planning documents at all, leaving decisions about property distribution, guardianship, and medical wishes up to default state law rather than personal choice.

The gap between awareness and action is significant. Many people acknowledge the potential benefits of planning—such as controlling how assets are distributed, designating guardians for minor children, and simplifying affairs for loved ones—yet procrastination, misconceptions about needing “enough” assets, and other barriers prevent them from completing legal documents.

Laramie Estate Planning FAQs

Planning for the future isn’t always easy, but it’s one of the most important steps you can take to protect your loved ones and your assets. An experienced Laramie, WY estate planning lawyer can provide guidance on creating wills, trusts, and other legal documents to ensure your wishes are carried out. Davis & Johnson Law Office has many different seasoned lawyers who will know how to assist. The lawyers have over 50 years of experience and specialize in estate planning, so know what they are talking about. Here are some common questions people ask about the process.

What Does An Estate Planning Lawyer Do?

An estate planning lawyer helps clients organize their financial and personal affairs for the future. This includes drafting wills, setting up trusts, creating powers of attorney, and establishing health care directives. Their role is to make sure your plans are legally sound and tailored to your unique situation.

Why Is Estate Planning Important?

Without a clear estate plan, state laws may determine how your assets are distributed, which might not reflect your wishes. Estate planning also helps reduce family disputes, avoid unnecessary taxes, and ensure children or dependents are cared for properly.

Do I Need A Lawyer If I Already Have A Will?

A will is an important start, but it often isn’t enough on its own. A Laramie estate planning lawyer can help ensure your will is up to date, legally enforceable, and aligned with other parts of your estate plan. They may also recommend tools like trusts that provide additional benefits.

When Should I Start Estate Planning?

It’s never too early to start. Major life events—like marriage, having children, buying a home, or starting a business—are all times when estate planning becomes especially important. Updating your plan regularly ensures it always reflects your current wishes. It can also even help protect an estate from creditors.

How Can An Estate Planning Lawyer Help My Family?

By working with an estate planning lawyer, you can give your family peace of mind. They’ll know your wishes have been clearly documented, reducing the risk of conflict and confusion during already difficult times. A lawyer also ensures that the legal process is smoother and less stressful for your loved ones. Your lawyer can answer questions about probate and help with all estate planning needs.

Estate planning is ultimately about protecting what matters most—your family, your legacy, and your peace of mind. A Laramie estate planning lawyer can guide you through each step with clarity and confidence, making sure your future is secure. Reach out today to learn more.

Laramie Estate Planning Glossary

When considering the future of your assets and loved ones, working with a Laramie estate planning lawyer helps you make informed decisions about protecting what matters most. At Davis & Johnson Law Office, we guide clients through the legal tools and processes that preserve wealth, minimize tax burdens, and honor your wishes for generations to come.

Estate planning involves more than drafting a simple will. It requires careful consideration of tax implications, asset protection strategies, and the specific needs of your beneficiaries. Understanding the fundamental concepts behind these legal instruments allows you to participate actively in creating a comprehensive plan that reflects your values and priorities.

Testamentary Trust

A testamentary trust is a legal arrangement created through provisions in your will that only takes effect after your death. Unlike trusts established during your lifetime, this type of trust doesn’t exist until the probate process concludes and your will is validated by the court. We often recommend testamentary trusts for clients who want to control how and when beneficiaries receive their inheritance, particularly when minor children or individuals who may not be prepared to manage large sums of money are involved.

The trust operates according to instructions you specify in your will, with a designated trustee managing the assets on behalf of your beneficiaries. This arrangement provides flexibility in determining distribution schedules—for example, you might specify that beneficiaries receive portions of their inheritance at certain ages or life milestones. The trust can also protect assets from creditors, divorce proceedings, or poor financial decisions by beneficiaries. While testamentary trusts must go through probate, they offer significant advantages in controlling asset distribution and providing long-term financial security for your loved ones.

Power Of Attorney

A power of attorney is a legal document that authorizes someone you trust to make decisions and take actions on your behalf. This authority can be broad or limited to specific matters, such as managing real estate transactions, handling banking affairs, or making medical decisions. We recommend establishing both financial and healthcare powers of attorney as part of a complete plan, so someone you trust can step in if you become unable to manage your own affairs.

The scope and duration of this authority depends on the type of power of attorney you create. A durable power of attorney remains in effect even if you become incapacitated, while a general power of attorney typically ends if you’re unable to make decisions yourself. You can also create a springing power of attorney that only activates under specific circumstances, such as a doctor certifying that you’re incapacitated. Choosing the right person for this role requires careful thought—your attorney-in-fact will have significant authority, so selecting someone with good judgment, integrity, and understanding of your wishes is paramount.

Irrevocable Life Insurance Trust

An irrevocable life insurance trust (ILIT) is a specialized trust designed to own life insurance policies outside of your taxable estate. Once you transfer a policy into this trust, you cannot modify or revoke the arrangement, which is why the decision to establish one requires thorough analysis of your financial situation and long-term goals. We work with clients to determine whether the benefits of removing life insurance proceeds from their taxable estate outweigh the loss of control over the policy.

The primary advantage of an ILIT is estate tax reduction. Life insurance death benefits are typically included in your taxable estate if you own the policy at death, potentially creating a significant tax burden for your heirs. By transferring ownership to an irrevocable trust, the death benefit passes to your beneficiaries free from estate taxes. The trust also protects the insurance proceeds from creditors and provides controlled distribution to beneficiaries. Setting up an ILIT requires careful attention to timing, funding, and administration—policies must be transferred at least three years before death to avoid estate tax inclusion, and annual contributions to pay premiums may require filing gift tax returns.

Living Will

A living will is an advance directive that communicates your preferences for medical treatment if you become unable to express your wishes. This document addresses end-of-life care decisions, including whether you want life-sustaining treatments such as mechanical ventilation, artificial nutrition, or resuscitation. We help clients create living wills that provide clear guidance to healthcare providers and family members during difficult times when emotions run high and disagreement may occur.

Your living will typically addresses specific medical scenarios—persistent vegetative states, terminal illness, or irreversible conditions—and specifies which interventions you would or wouldn’t want in each situation. This document works in conjunction with a healthcare power of attorney, which designates someone to make medical decisions on your behalf. While your healthcare agent can make many treatment decisions, a living will provides specific instructions that guide their choices and reduce the burden of making difficult decisions without knowing your wishes. We recommend reviewing and updating your living will periodically, particularly after major health changes or shifts in your medical treatment preferences.

Beneficiary Designation

A beneficiary designation is a contractual instruction that determines who receives assets from accounts like retirement plans, life insurance policies, and payable-on-death bank accounts when you pass away. These designations operate outside of your will and bypass the probate process, transferring directly to the named individuals or entities. We review all beneficiary designations with clients because outdated or incorrect designations can undermine your entire planning strategy.

Keeping beneficiary designations current is one of the most overlooked aspects of planning. Life changes such as marriage, divorce, births, and deaths require updates to these forms, yet many people complete them once and never revisit them. Failing to update designations can result in an ex-spouse receiving your life insurance proceeds or a deceased person remaining listed on your retirement account. We also help clients coordinate beneficiary designations with their overall plan to minimize tax consequences—for example, naming a trust rather than an individual as a retirement account beneficiary may provide better creditor protection and controlled distributions. Regular reviews prevent common pitfalls and keep your assets flowing according to your current wishes.

If you’re ready to create or update your plan, contact us today to schedule a consultation and discuss the legal tools that best serve your family’s needs.