Cheyenne Estate Planning Lawyer

Securing Your Future With An Estate Plan

If you are prepared to start planning for the future, our Cheyenne, WY estate planning lawyer is here to help you. An estate plan is an incredibly important way to protect your wishes, your future, and the future of your friends and family. Our dedicated attorneys have over 50 years of combined assistance helping clients plan for their future. We provide a variety of estate planning services, including assistance with wills and trusts, powers of attorney, advanced healthcare directives, guardianship designations, and more. To discuss your estate plan with us, contact Davis & Johnson Law Office today to schedule a consultation.

Wills And Trusts

Our Cheyenne estate planning attorney will help you draft, review, and update a thorough and sound will that comprehensively lists your wishes for the future and instructions for the maintenance and distribution of your assets. As well as laying out instructions for asset distribution, wills can also name an executor, leave instructions for the payment of taxes and debts, transition investments, and more.

Trusts provide options that wills cannot. In some cases, trusts allow the placement of conditions on gifts and special instructions for final arrangements. They can also allow the probate process to be bypassed. Our estate planning lawyer will discuss your situation with you and help you determine if a will or a trust is the best option for you and your future.

Powers Of Attorney

A durable power of attorney is a document that appoints an “agent,” who is often a close friend or family member, to act on your behalf in the event that you become incapacitated or unable to do so. Agents can make decisions related to legal, financial, and healthcare matters. Our estate planning lawyer will help you prepare a power of attorney document so that the decision process for such matters is made easier for your family in the event that you become incapacitated.

Advanced Healthcare Directives And Guardianship Designations

An advanced healthcare directive is a document that outlines instructions for your medical care and wishes. This document only goes into effect if you are incapacitated and cannot communicate your own wishes. Our Wyoming estate planning lawyer can help you understand the implications of advanced healthcare directives and what instructions that you should include in yours.

Additionally, our estate planning lawyer can also help you draft a document to legally appoint a guardian for any minor children that you may have in the event that you are no longer able to care for them.

Receive Dedicated Assistance With Your Estate Plan Today

When it comes to something as important as an estate plan, receiving the assistance of an experienced professional is crucial. Our dedicated estate planning lawyer will work hand-in-hand with you to craft an estate plan that meets your needs and wishes and is legally and functionally sound, protecting your future and that of your friends and family. To start your estate planning journey, contact Davis & Johnson Law Office today to schedule a consultation.

Services Offered By An Estate Planning Lawyer

Estate planning is an essential aspect of managing your assets and ensuring that your wishes are honored after you pass away. An estate planning lawyer plays a crucial role in helping you navigate the complex legal landscape involved in this process. Here, we’ll explore the variety of services provided by our estate planning law firm and why working with our attorneys can bring you peace of mind.

Ensuring Smooth Asset Transfer

An estate planning lawyer helps ensure the smooth transfer of your assets to your beneficiaries. By creating detailed plans for asset distribution, they help prevent potential conflicts and confusion among your heirs. This process includes reviewing and organizing your financial and property records, designating beneficiaries, and ensuring that all legal requirements are met. By clearly outlining your intentions and legally documenting them, an estate planning lawyer can help your loved ones avoid the stress and uncertainty that often accompany asset transfer after a loved one’s passing.

Establishing Trusts For Various Needs

Trusts are versatile tools in estate planning, serving various purposes such as managing assets, reducing tax liabilities, and protecting beneficiaries. A Cheyenne estate planning attorney can help you establish different types of trusts, including revocable living trusts, irrevocable trusts, and special needs trusts. Each type has unique benefits and requirements, and your lawyer will guide you in selecting the best option for your circumstances.

Navigating Probate Proceedings

Probate is the legal process through which a deceased person’s will is validated and their estate is administered. This process can be complex and time-consuming. An estate planning lawyer provides invaluable assistance in navigating probate proceedings, ensuring that the administration of the estate is handled efficiently and in accordance with the law. Their expertise can help minimize delays and conflicts during this challenging time.

Designating Powers Of Attorney

Designating powers of attorney is a crucial part of estate planning. A power of attorney grants someone the authority to make financial or medical decisions on your behalf if you become incapacitated. An estate planning lawyer will help you draft and implement these documents, ensuring that your designated agent has the legal authority to act in your best interests when you are unable to do so.

Planning For Incapacity With Advance Directives

Advance directives, such as living wills and healthcare proxies, are essential components of a comprehensive estate plan. These documents outline your preferences for medical treatment and designate someone to make healthcare decisions on your behalf if you are unable to do so. An estate planning lawyer can help you articulate your wishes clearly and ensure that your advance directives comply with state laws.

Minimizing Estate Taxes And Maximizing Inheritance

One of the key goals of estate planning is to minimize estate taxes and maximize the inheritance passed on to your beneficiaries. Your estate planning lawyer will use various strategies to achieve this, such as establishing trusts, gifting assets during your lifetime, and taking advantage of tax exemptions. Their expertise in tax law ensures that your estate plan is as tax-efficient as possible.

Updating And Reviewing Your Estate Plan

Life changes, such as marriage, divorce, the birth of a child, or significant financial shifts, necessitate updates to your estate plan. Your estate planning lawyer provides ongoing support by regularly reviewing and updating your plan to reflect these changes. This ensures that your estate plan remains aligned with your current situation and wishes.

Providing Peace Of Mind Through Professional Guidance

Ultimately, the primary benefit of working with an estate planning lawyer is the peace of mind that comes from knowing your affairs are in order. Professional guidance ensures that every aspect of your estate plan is legally sound and tailored to your specific needs and goals. Whether you are just starting your estate planning journey or need to update an existing plan, an estate planning lawyer is your trusted partner in protecting your legacy.

Reach Out Today

Secure your future and protect your loved ones by taking the first step in estate planning today. Contact our experienced Cheyenne estate planning lawyers to schedule a consultation. Let Davis & Johnson Law Office help you create a comprehensive estate plan that brings you peace of mind and ensures your wishes are honored.

Steps To The Estate Planning Process

Planning for the future is essential, and having a solid plan for your estate ensures that your wishes are honored and your loved ones are taken care of. Here’s a comprehensive look at what to expect throughout the estate planning process. Always speak with a skilled Cheyenne, WY estate planning lawyer to determine what kind of services you can use. Davis & Johnson Law Office has extensive experience in helping with this. We have over 50 years of experience and will understand how to best navigate the next steps.

Initial Consultation

The first step in the estate planning process is meeting with a qualified Cheyenne estate planning attorney to discuss your goals, concerns, and specific needs. During this initial consultation, you’ll talk about your family dynamics, financial situation, and any particular wishes you have for your estate. This meeting sets the stage for crafting a personalized plan that aligns with your intentions.

Gathering Information

After your initial consultation, the next step involves gathering detailed information about your assets, liabilities, and family situation. You’ll need to compile documents such as bank statements, investment accounts, property deeds, and existing insurance policies. This step is crucial for your attorney to get a comprehensive view of your estate and ensure nothing is overlooked.

Drafting The Plan

Once all relevant information is collected, your attorney will begin drafting your estate plan. This typically includes the preparation of several key documents such as a will, trust agreements, powers of attorney, and healthcare directives. Each document serves a specific purpose in ensuring your wishes are clearly articulated and legally binding.

Reviewing And Revising

One of our Cheyenne estate planning attorneys will present the draft plan for your review. It’s important to thoroughly go through each document to ensure it accurately reflects your wishes. Don’t hesitate to ask questions or request changes. This step is collaborative, and your attorney’s goal is to create a plan that gives you peace of mind.

Signing The Documents

After you’re satisfied with the draft, the next step is to sign the documents. This often requires witnessing and notarization to ensure they are legally enforceable. Your attorney will guide you through this process, ensuring all legal formalities are correctly followed.

Funding The Trust

If your estate plan includes a trust, you’ll need to transfer assets into it. This process involves re-titling assets like real estate, bank accounts, and investment accounts into the name of the trust. Properly funding your trust is critical to ensure it operates as intended.

Communicating Your Plan

It’s essential to communicate your plan to relevant parties, such as your executor, trustees, and family members. While you may not need to disclose every detail, ensuring key individuals understand their roles and your general intentions can prevent confusion and disputes later.

Periodic Review And Updates

Life circumstances and laws change, and so might your wishes. Regularly reviewing and updating your estate plan is crucial to ensure it remains aligned with your current situation and goals. Significant life events like marriage, divorce, the birth of a child, or acquiring new assets should prompt a review of your plan.

Implementing Your Plan

Ultimately, your estate plan will need to be implemented upon your passing or incapacity. Having a well-drafted plan ensures this process is smooth and less stressful for your loved ones. Your designated executor or trustee will oversee the distribution of your assets according to your instructions, and your healthcare directives will guide medical decisions if you’re unable to do so.

Seeking Ongoing Guidance

Estate planning isn’t a one-time event but an ongoing process. Building a relationship with a knowledgeable attorney ensures you have expert guidance whenever you need to make adjustments or navigate complex situations.

Reach Out Today

Creating a comprehensive estate plan is a thoughtful way to provide for your loved ones and ensure your wishes are respected. If you’re ready to start the estate planning process or need to update your existing plan, contact us today to schedule a consultation.

Our experienced team of Cheyenne estate planning attorneys is here to help you every step of the way, providing the peace of mind that comes with knowing your future is well planned. Davis & Johnson Law Office would be honored to help you in moving forward with your estate plan.

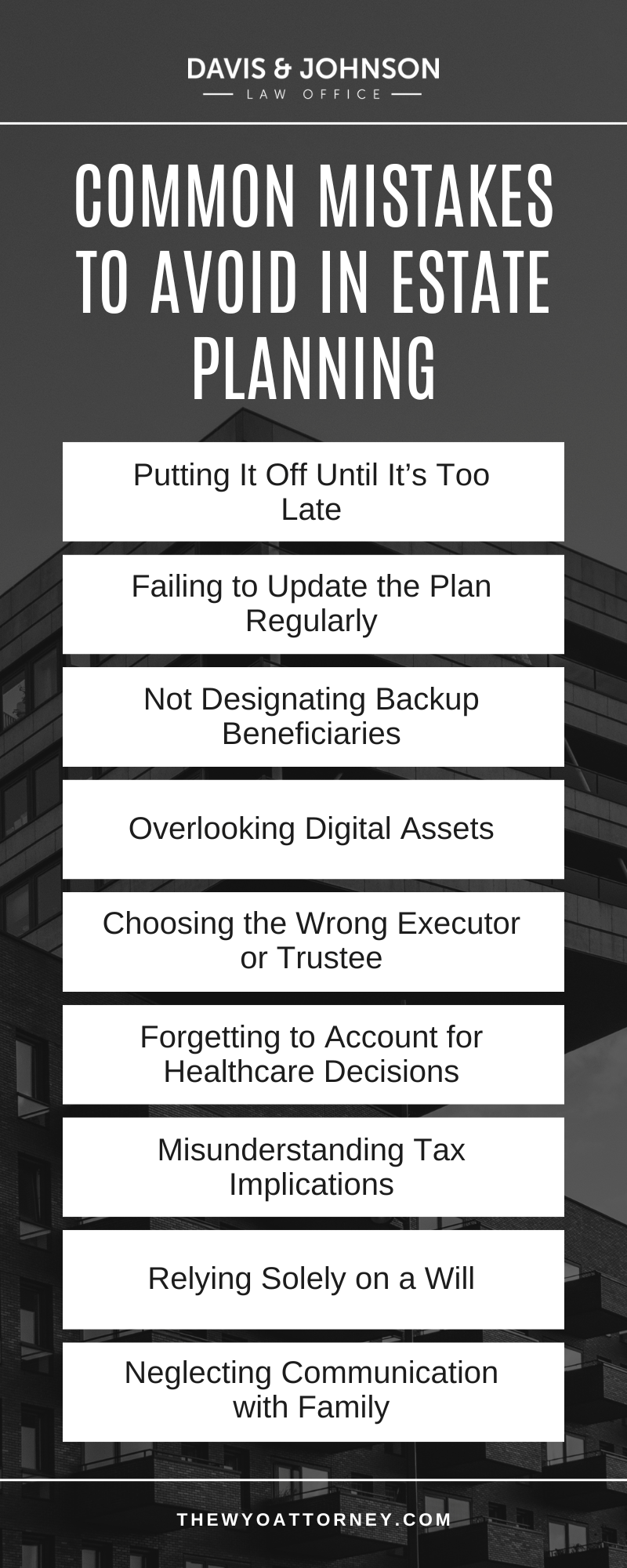

Cheyenne Estate Planning Infographic

Cheyenne Estate Planning Statistics

Estate planning is a critical yet underutilized aspect of personal financial management in the United States. Despite its importance, only 33% of U.S. adults have created estate planning documents, such as wills or trusts. This leaves a significant portion of the population unprepared for the distribution of their assets upon death.

The reasons for this lack of preparation vary. A common misconception is that estate planning is only necessary for the wealthy. In reality, individuals with modest estates can benefit from having a plan to ensure their wishes are honored and minimize potential conflicts among survivors.

Procrastination is another major barrier. Many individuals recognize the importance of estate planning but delay taking action. This delay can result in unintended consequences, including the state’s involvement in asset distribution and increased costs for heirs.

Demographic factors also influence estate planning behaviors. Older adults are more likely to have estate plans, while younger individuals, especially those without dependents, often postpone creating one. However, life events such as marriage, the birth of children, or significant health changes can serve as catalysts for initiating estate planning.

Estate Planning FAQs

Planning an estate can be difficult. Our seasoned Wyoming estate planning lawyer can be of great assistance. Davis & Johnson Law Office has over 50 years of experience in this field and will speak with you in detail to determine how to best assist in planning your estate. Continue reading to get answers to some of the questions we hear the most from clients who are in similar shoes as you.

Why Do I Need An Estate Plan If I Don’t Have Many Assets?

An estate plan is essential for everyone, not just those with significant wealth. Even if you don’t have a vast estate, you likely have assets that matter to you—whether it’s your home, your savings, or personal items of sentimental value. Estate planning ensures that these assets are distributed according to your wishes after you’re gone.

Without a plan in place, state laws will determine how your assets are divided, which may not align with your preferences. Additionally, an estate plan provides for the care of minor children, helps manage your finances if you become incapacitated, and can prevent legal complications for your loved ones.

Isn’t Estate Planning Only Necessary For Older People?

It’s a common misconception that estate planning is only for older individuals. The truth is that life is unpredictable, and having an estate plan in place at any age is a wise decision. Whether you’re in your 20s, 30s, or beyond, an estate plan protects your interests in case something unexpected happens.

For young adults, especially those with children or property, it’s crucial to have a plan that addresses guardianship and asset distribution. Estate planning is about preparing for the future, no matter where you are in life. A skilled Cheyenne estate planning attorney can help with this.

What Does An Estate Plan Typically Include?

An estate plan can be as simple or as complex as your situation requires. At its core, an estate plan includes a will, which outlines how your assets will be distributed. It may also include a living will, which details your wishes for medical care if you become incapacitated.

Power of attorney documents are another key component, designating someone to make financial or medical decisions on your behalf if you’re unable to do so. For those with more complex needs, an estate plan might involve setting up trusts, which can help manage and protect assets for your beneficiaries. The specific elements of your estate plan will depend on your personal circumstances and goals.

What Happens If I Don’t Have An Estate Plan?

If you pass away without an estate plan, the distribution of your assets will be governed by state law, which may not reflect your wishes. This process, known as intestate succession, often results in a lengthy and complicated probate process, which can be stressful and costly for your loved ones.

Without an estate plan, you also lose control over who will care for any minor children, and your healthcare and financial decisions may be left in the hands of a court-appointed individual. Estate planning is the only way to ensure that your wishes are honored and that your family is protected from unnecessary legal battles.

Is Estate Planning Expensive?

The cost of estate planning varies depending on the complexity of your situation, but it is generally a worthwhile investment. Basic estate planning, which includes a will and power of attorney documents, can be relatively affordable.

While there may be some upfront costs, the long-term benefits of having a plan in place far outweigh the expense. Moreover, a well-crafted estate plan can save your loved ones from costly probate fees and potential disputes in the future. It’s important to view estate planning as an investment in peace of mind for you and your family.

Can I Create My Own Estate Plan Without A Lawyer?

While it’s possible to create your own estate plan using online tools, it’s often not advisable. Estate planning involves complex legal and financial considerations that a non-professional may not fully understand. Mistakes in a DIY estate plan can lead to significant issues down the line, including the invalidation of your documents.

Working with an experienced estate planning lawyer ensures that your plan is comprehensive, legally sound, and tailored to your specific needs. Cheyenne estate planning lawyers can help you navigate any challenges and make informed decisions that will protect your interests and those of your loved ones.

How Often Should I Update My Estate Plan?

It’s important to review and update your estate plan regularly, especially after major life events such as marriage, the birth of a child, or the purchase of a home. Even without significant changes in your life, it’s a good idea to revisit your estate plan every few years to ensure it still reflects your wishes and complies with current laws. Keeping your estate plan up to date ensures that it continues to protect your assets and loved ones effectively.

What Is The Difference Between A Will And A Trust?

A will and a trust are both essential estate planning tools, but they serve different purposes. A will outlines how your assets will be distributed after your death and names a guardian for minor children if necessary. However, it must go through probate, a legal process that can be time-consuming and costly.

A trust, on the other hand, allows your assets to be distributed without going through probate. It can also provide privacy and reduce the tax burden on your heirs. Additionally, a trust is helpful for managing assets if you become incapacitated, allowing someone you trust to take over your financial affairs while you’re still alive. Many people choose to use both a will and a trust to cover all their bases. A good estate planning attorney can help tell you what would be best for your estate.

How Can I Protect My Family With Estate Planning?

One of the main reasons people engage in estate planning is to protect their loved ones. Through a well-structured estate plan, you can make sure that your family is financially secure, even if something happens to you. In addition to distributing assets, you can set up guardianship for minor children, designate beneficiaries for life insurance policies and retirement accounts, and establish trusts to provide for children’s education or other long-term needs. These steps give your family peace of mind, knowing they are protected and that your wishes will be respected.

Do I Need A Lawyer To Create An Estate Plan?

While it’s possible to create a basic will or trust using online resources, working with an estate planning lawyer ensures that your plan is legally sound and tailored to your specific situation. Laws regarding estate planning vary from state to state, and a lawyer can help you navigate these regulations to avoid costly mistakes. An experienced lawyer can also help you create complex plans involving trusts, charitable giving, or special circumstances that require more detailed attention.

When Should I Start Estate Planning?

It’s never too early to start planning your estate. While many people think they should wait until later in life to begin this process, the truth is that estate planning is valuable for anyone with assets or family responsibilities. Major life events such as getting married, having children, buying a home, or starting a business are good times to consider putting a plan in place. As life changes, you can always update your estate plan to reflect your new circumstances. The key is to have something in place sooner rather than later.

Start Your Journey Today

Taking the first step toward estate planning can be overwhelming, but it doesn’t have to be. Our team is here to guide you through the process, ensuring that your plan is comprehensive and tailored to your unique needs. Don’t wait until it’s too late—contact Davis & Johnson Law Office today to schedule a consultation and secure peace of mind for yourself and your loved ones. Your future is too important to leave to chance.

Common Mistakes To Avoid In Estate Planning

Estate planning is an essential process to protect your loved ones and ensure your wishes are honored. Yet, it’s easy to make simple errors that can lead to complications. As a Cheyenne, WY estate planning lawyer, we see a few common mistakes that people often make. Here’s a look at some pitfalls to avoid to keep your estate plan effective and efficient.

1. Putting It Off Until It’s Too Late

One of the most frequent mistakes is delaying estate planning altogether. Life is unpredictable, and waiting too long to set up a plan can leave families unprepared. By starting early, you make sure your assets are distributed as you choose and that your healthcare and financial wishes are clear. The sooner you begin, the easier it is to make adjustments as life changes.

2. Failing to Update the Plan Regularly

Creating an estate plan is a major step, but it shouldn’t be a one-time effort. Over the years, life events like marriage, divorce, new children, or changes in assets require adjustments to the plan. If you forget to update it regularly, outdated information could lead to unintended distributions or tax consequences. Working with our Cheyenne estate planning lawyer can help you keep your plan current and reflective of your changing lives.

3. Not Designating Backup Beneficiaries

When you set up beneficiaries, it’s crucial to consider backups. If a primary beneficiary passes away or is unable to inherit, a backup (or contingent) beneficiary will step in. Without one, assets may go through probate, which can delay distributions and lead to unnecessary legal expenses. Naming alternates for all beneficiaries helps avoid this issue.

4. Overlooking Digital Assets

In today’s world, digital assets are increasingly important yet often forgotten in estate plans. This includes online accounts, social media profiles, and other digital property. If you don’t leave instructions, these assets may be difficult for loved ones to access or manage. Including them in the estate plan ensures that your digital legacy is protected and can be handled appropriately.

5. Choosing the Wrong Executor or Trustee

Selecting the right executor or trustee is essential, as they’ll be responsible for managing your estate. Choosing someone simply based on personal closeness might seem right, but not everyone has the skills or time required for this role. Picking someone dependable, financially responsible, and familiar with legal procedures will have the best result. Consulting with our Cheyenne estate planning lawyer can help you make this important choice confidently.

6. Forgetting to Account for Healthcare Decisions

Estate planning isn’t just about financial assets; it also involves making decisions about your future healthcare. Creating an advance healthcare directive or appointing a healthcare proxy helps ensure your medical preferences are honored if we’re unable to communicate. Without these documents, family members might face difficult decisions without clear guidance.

7. Misunderstanding Tax Implications

Many people don’t realize how taxes can affect their estate. Even smaller estates can sometimes face state or federal tax issues. Without proper planning, heirs may have to pay unnecessary taxes or face delays in receiving their inheritance. Working with a lawyer can help understand any tax implications and structure a plan in a way that minimizes taxes.

8. Relying Solely on a Will

A will is a fundamental part of any estate plan, but it’s often not enough by itself. Other tools, like trusts, can provide additional control, reduce probate time, and offer better privacy. Trusts are especially helpful for managing assets for minors, ensuring specific uses for funds, and avoiding the probate process. By broadening your plan beyond a will, you can achieve more comprehensive coverage of your assets and wishes.

9. Neglecting Communication with Family

Lastly, failing to discuss your estate plans with family members can lead to confusion and conflicts later. While not every detail needs to be shared, letting your family know about major decisions can ease their concerns and clarify your wishes. Open communication now can prevent misunderstandings and help your loved ones carry out your plan with confidence.

Contact Us Today

Avoiding these common estate planning mistakes helps us create a stronger, more effective plan. At Davis & Johnson Law Office, we’re here to guide you through each step, making sure your plan reflects your values and supports your family. Contact us today to speak with our experienced Cheyenne, WY estate planning lawyer and take the next step toward peace of mind for you and your loved ones.