Trust Lawyer Cheyenne, WY

Planning For The Future With A Trust

If you are considering creating a trust as part of your estate plan, our Cheyenne, WY trust lawyer is here to help you. Creating a comprehensive estate plan is a crucial component of ensuring that your future, and the future of your family and friends, is secure. Our dedicated trust lawyers have over 50 years’ worth of experience assisting clients with their estate plans. With our extensive knowledge and history of success on your side, you can rest assured that your estate plan is in good hands. To begin discussing your trust, contact our team at Davis & Johnson Law Office today to schedule a consultation.

Table of Contents

- Planning For The Future With A Trust

- The Importance Of A Trust Lawyer

- Safeguarding Your Assets With a Trust

- Cheyenne Trust Infographic

- Cheyenne Trust Statistics

- Cheyenne Trust FAQs

- Cheyenne Trust Glossary

- Davis & Johnson Law Office, Cheyenne Trust Lawyer

- Contact Our Cheyenne Trust Lawyer Today

An Overview Of Trusts

A living trust gives you the ability to place your assets into a trust while still maintaining control of them during your lifetime. Once you have passed, the assets in your trust will be passed onto the beneficiaries that you have noted. One benefit of creating a living trust rather than a will is that assets placed in a living trust do not have to go through the process of probate before being distributed, significantly simplifying the process.

In creating a trust, you will name a trustee who is in charge of maintaining and managing the assets in the trust. Oftentimes, you will name yourself as the trustee in order to maintain control over your assets. A successor trustee will be named to oversee the distribution of the assets according to your wishes after your death.

When making decisions regarding your trust, it is important to understand the difference between revocable and irrevocable trusts. A revocable trust is a trust that can be altered, amended, or revoked at any point during your lifetime, giving you the flexibility to update your estate plan with the changes that will come during your life. Once you have passed, a revocable trust can no longer be amended.

An irrevocable trust is a trust that cannot be amended at any point once it has been established. Once you place your assets in an irrevocable trust, you essentially sign away ownership and control of these assets. This particular type of trust is often used to protect assets for tax advantages. Our Cheyenne elder law attorney will help you understand your trust and what options are best for you.

Tax Benefits Of Trusts

Certain trusts can also have important tax benefits for their creators and beneficiaries. Benefits such as estate tax reductions, protection from capital gains tax, charitable deductions, gift tax advantages, and income tax planning benefits can be added incentives to create a trust. To discover exactly how a trust might benefit you and your beneficiaries, contact our Wyoming trust lawyer.

Our Professional Assistance With Your Trust

While trusts can be extremely beneficial and make the process of distributing your assets much easier for your beneficiaries after your death, they can also be quite complicated to establish. Our experience assisting clients with trusts and knowledge of the laws regarding trusts in Wyoming can make the process easy for you. We will ensure that your trust is valid, enforceable, and accurately reflects your wishes and goals. To start your estate planning journey with a trust, contact Davis & Johnson Law Office today.

The Importance Of A Trust Lawyer

In the realm of estate planning, the role of a trust lawyer is often overlooked. However, having a dedicated Cheyenne trust lawyer can be the difference between a seamless transition of assets and a tangled web of legal issues. Here, we delve into why engaging a trust lawyer is essential for anyone looking to protect their estate and ensure their wishes are honored. Davis & Johnson Law Office would be happy to help you plan your future.

Trust Law Experience

Trust lawyers possess the expertise needed to navigate these complexities, ensuring that your trust is established correctly and complies with all relevant laws. This expertise is invaluable when it comes to drafting documents that will stand up to scrutiny and effectively manage your assets according to your wishes.

Personalized Legal Advice

Every individual’s financial situation and goals are unique. A trust lawyer provides personalized legal advice tailored to your specific needs. They take the time to understand your circumstances, goals, and concerns, allowing them to create a trust that reflects your intentions precisely. This personalized approach ensures that your trust is structured in a way that best suits your situation, providing peace of mind that your estate will be handled as you envision.

Ensuring Legal Compliance

Laws regarding trusts can vary significantly from one jurisdiction to another, and they can also change over time. Our estate lawyers stay abreast of these changes and ensure that your trust remains compliant, thus avoiding potential legal issues down the line. This compliance is crucial for the validity and enforceability of your trust.

Minimizing Tax Liabilities

Tax considerations are a significant aspect of estate planning. Trust lawyers are well-versed in the tax implications of various types of trusts and can help you structure your trust in a way that minimizes tax liabilities. By leveraging their knowledge of tax laws, trust lawyers can help you preserve more of your estate for your beneficiaries, rather than losing a substantial portion to taxes.

Protecting Beneficiaries

A trust is often set up to protect the interests of your beneficiaries, particularly if they are minors, disabled, or otherwise vulnerable. Trust lawyers can design trusts that safeguard these beneficiaries by controlling how and when the assets are distributed. This protection ensures that your beneficiaries receive the support they need without the risk of mismanagement or exploitation.

Avoiding Probate

One of the significant advantages of having a trust is that it can help your estate avoid the lengthy and costly probate process. Probate can be time-consuming and stressful for your loved ones. A trust lawyer can establish a trust that allows your estate to bypass probate, ensuring a quicker and more efficient transfer of assets to your beneficiaries.

Addressing Potential Disputes

Family dynamics can sometimes lead to disputes over the distribution of assets. A well-drafted trust, prepared by an experienced trust lawyer, can significantly reduce the likelihood of such disputes. Trust lawyers incorporate clear and precise language in the trust documents, leaving little room for interpretation or conflict. In the unfortunate event that a dispute does arise, having a trust lawyer can be instrumental in resolving it swiftly and effectively.

Ongoing Trust Management

A trust lawyer doesn’t just help you set up the trust; they also provide ongoing support and management. This ongoing relationship ensures that your trust remains effective and aligned with your wishes over time. Whether you need to make adjustments due to changes in your personal circumstances or in the law, a trust lawyer can assist in updating your trust accordingly.

Peace Of Mind

Ultimately, the most compelling reason to hire a trust lawyer is the peace of mind they provide. Knowing that your estate plan is in capable hands allows you to focus on other aspects of your life. Trust lawyers offer reassurance that your assets will be managed and distributed according to your wishes, providing security for you and your loved ones.

Take The Next Step

Don’t leave the future of your estate to chance. Contact our experienced trust attorneys today to ensure your estate is protected and your wishes are honored. With our expertise and personalized approach, you can rest easy knowing that your legacy is secure. Schedule a consultation with Davis & Johnson Law Office now and take the first step towards peace of mind.

Safeguarding Your Assets With A Trust

When planning for the future, it’s crucial to ensure that your assets are protected and your wishes are honored. Our Wyoming trust lawyer can offer invaluable assistance. They can help you navigate the complexities of asset management and legal documentation, ensuring that your estate is handled according to your preferences. Here’s a look at several key areas they can help you safeguard. Davis & Johnson Law Office has extensive experience in this field. We work closely with our clients to ensure they are happy with the service we provide.

Family Heirlooms And Personal Property

Family heirlooms and personal property often carry significant sentimental value. Legal experts can assist you in documenting and preserving these items, ensuring they are passed down to the right individuals. By creating detailed instructions within your legal documents, you can prevent disputes among family members and ensure that these treasured items are kept within the family.

Real Estate And Properties

Real estate is often one of the most valuable components of an estate. Professionals in this field can help you establish clear ownership and transfer processes for your properties. Whether you own a family home, vacation property, or investment real estate, we can guide you through setting up the appropriate legal structures to protect these assets and minimize tax liabilities.

Financial Investments

Your financial portfolio, including stocks, bonds, and mutual funds, needs careful management to ensure it is distributed according to your wishes. Our skilled trust attorneys can provide guidance on how to best structure your investments within your estate plan. This includes advice on beneficiary designations, tax implications, and strategies for maximizing the value of your investments for your heirs.

Business Interests

If you own a business, planning for its future is critical. Our legal professionals can help you develop a succession plan that ensures your business continues to operate smoothly after your passing. They can also assist in determining the best way to transfer ownership, whether it be to family members, partners, or third parties, and ensure that the transition is as seamless as possible.

Retirement Accounts

Retirement accounts are a key component of your financial security. Our estate planning lawyers can help you navigate the specific rules and regulations associated with these accounts, ensuring that they are properly managed and transferred. They can also advise on the most tax-efficient ways to handle these accounts to benefit your heirs.

Charitable Contributions

Many people wish to leave a legacy through charitable contributions. Legal professionals can assist in setting up charitable trusts or foundations, ensuring that your philanthropic goals are achieved in a manner that aligns with your values and maximizes the impact of your contributions.

Healthcare Decisions

An often-overlooked aspect of estate planning is healthcare decision-making. By establishing clear directives and powers of attorney, you can ensure that your healthcare preferences are honored if you become unable to make decisions for yourself. Professionals can help you draft these documents to ensure they are legally binding and comprehensive.

Guardianship For Minor Children

For parents of minor children, it’s essential to designate guardians who will care for them in the event of your passing. Legal experts can help you formalize your wishes, providing peace of mind that your children will be cared for by trusted individuals.

Pet Care

Pets are often considered part of the family, and planning for their care is important. Professionals can help you set up arrangements to ensure your pets are cared for according to your wishes, including designating caregivers and setting aside funds for their care.

Digital Assets

In today’s digital age, managing digital assets is becoming increasingly important. From online bank accounts to social media profiles, professionals can help you plan for the management and transfer of these assets, ensuring they are handled appropriately.

Debt And Liability Management

Properly managing and settling debts is a crucial aspect of estate planning. Our legal professionals can assist in developing strategies to address outstanding liabilities, ensuring that your estate is not unduly burdened by debt and that your assets are distributed efficiently.

Whether you’re just starting your estate planning journey or need to update existing documents, it’s never too late to seek professional advice. Contact Davis & Johnson Law Office today to schedule a consultation and take the first step towards securing your legacy.

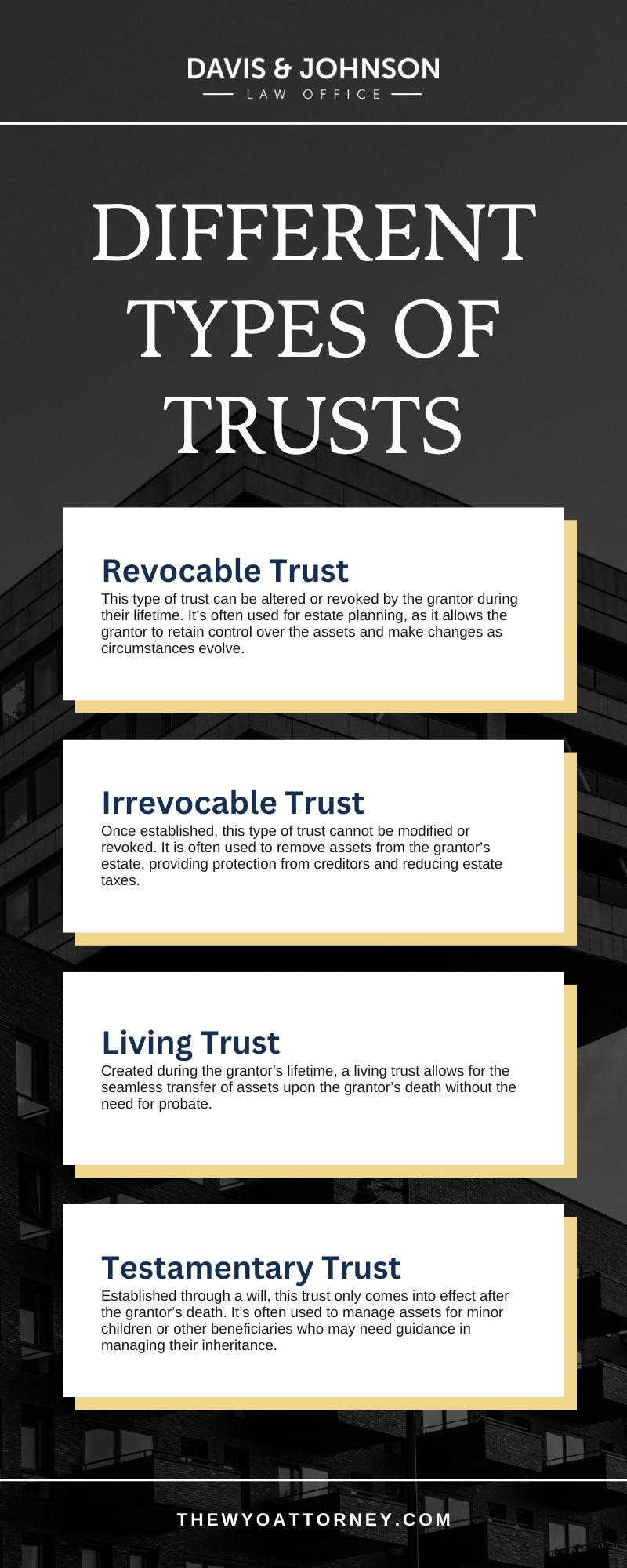

Cheyenne Trust Infographic

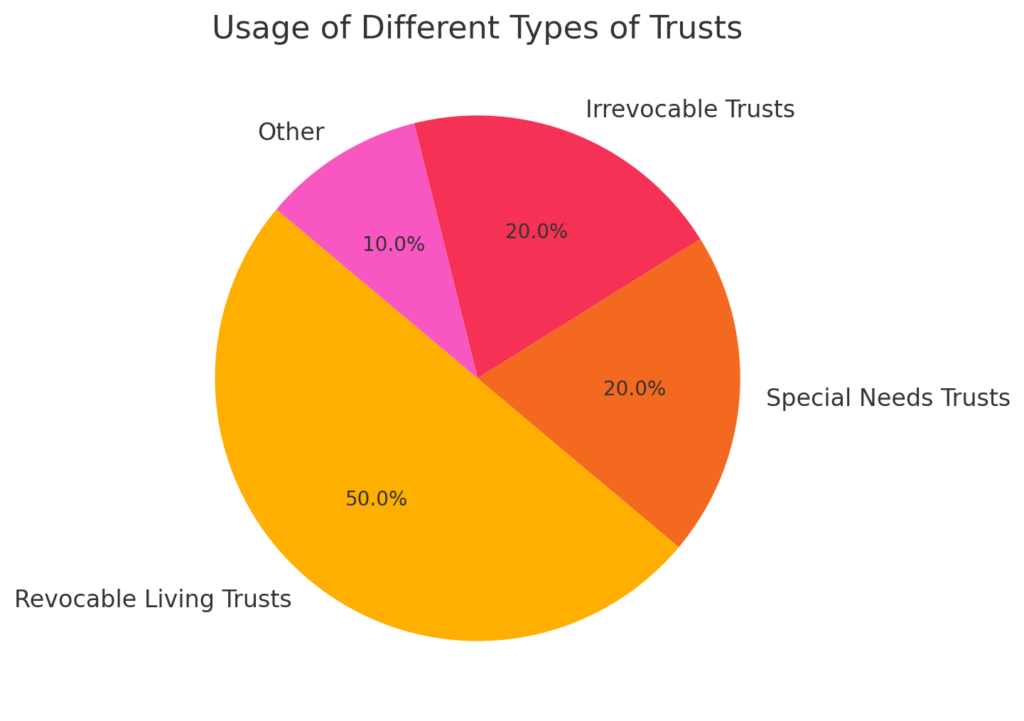

Cheyenne Trust Statistics

Trusts are a popular estate planning tool, with an estimated 20-30% of Americans incorporating them into their financial plans. Revocable living trusts are the most common, allowing individuals to maintain control over assets while avoiding probate.

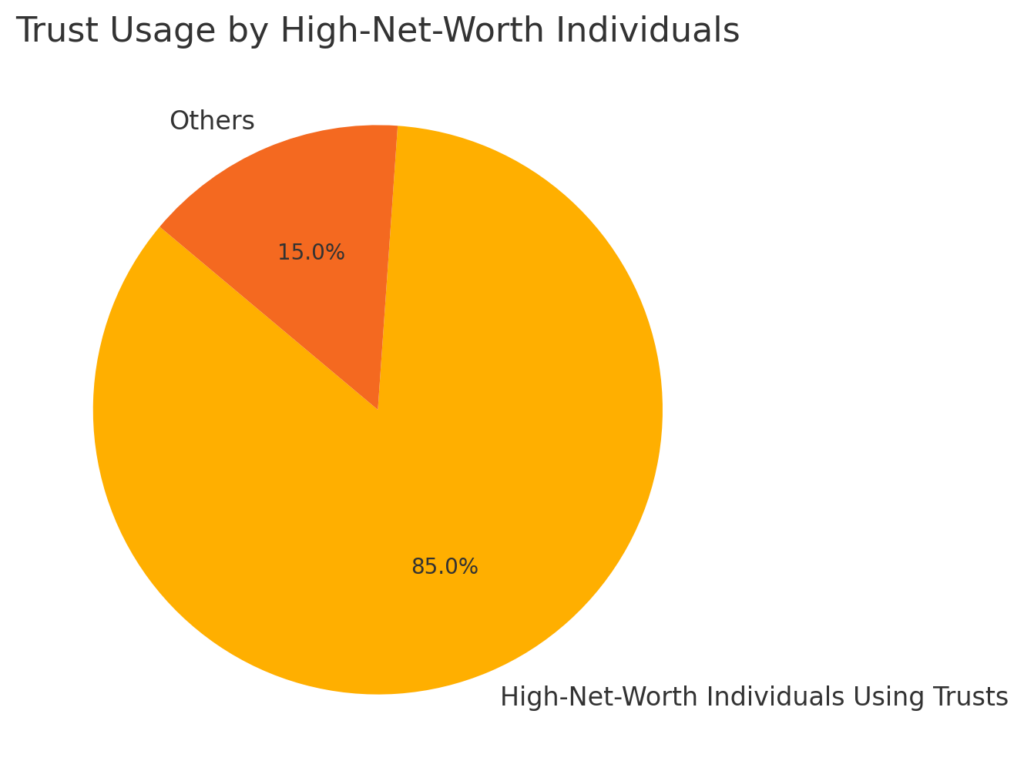

Approximately 85% of high-net-worth individuals use trusts to protect wealth and minimize estate taxes. Special needs trusts and irrevocable trusts are also widely used for long-term care and asset protection.

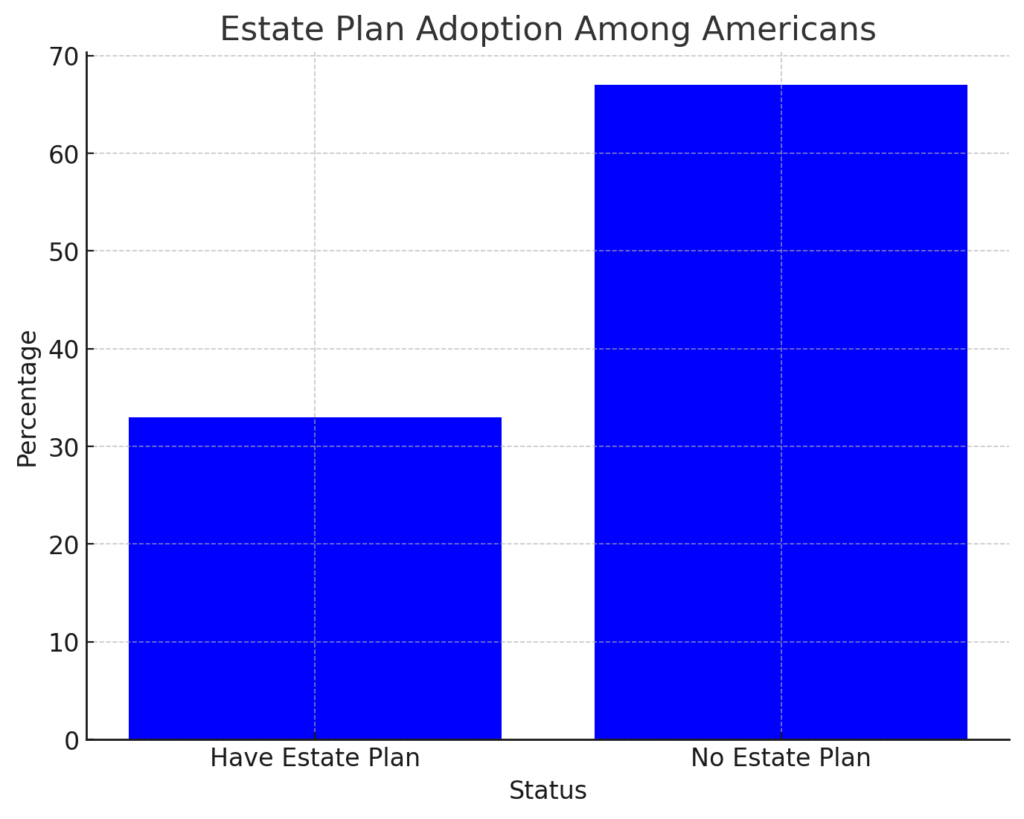

Despite their benefits, a significant portion of Americans lack awareness of trusts, with only 33% of adults having any form of estate plan, including trusts.

Cheyenne Trust FAQs

Having a trust is important for anyone, but you cannot have a good estate plan without an experienced Cheyenne trust attorney . Always reach out to someone with extensive experience so that you can get the assistance you deserve. Davis & Johnson Law Office offers personalized experiences, tailored to your own needs. Continue reading to learn about some of the most frequently asked questions regarding trusts.

What Is A Trust And How Does It Work?

A trust is a legal arrangement where one person, known as the trustee, holds and manages property for the benefit of another person, known as the beneficiary. Trusts can be created during a person’s lifetime (living trusts) or through their will (testamentary trusts). The primary purpose of a trust is to ensure that assets are managed and distributed according to the grantor’s wishes, often providing specific instructions on how and when the assets should be used.

Who Should Consider Having A Trust?

Anyone who wants to have greater control over how their assets are managed and distributed should consider setting up a trust. Trusts are particularly beneficial for individuals with complex estates, blended families, or significant assets. They can also be useful for parents of minor children, business owners, and those with charitable intentions. In essence, if you have specific wishes for how your assets should be handled after your passing, a trust can help ensure those wishes are carried out effectively.

Why Is A Trust Important For Estate Planning?

A trust is a vital tool in estate planning because it offers flexibility and control that a standard will cannot provide. With a trust, you can dictate not only who receives your assets but also when and how they receive them. This can be particularly important in situations where beneficiaries may not be ready to handle large sums of money, such as minor children or individuals with special needs. Additionally, trusts can help minimize estate taxes and avoid the lengthy probate process, ensuring a smoother transition of assets.

What Are The Different Types Of Trusts?

There are several types of trusts, each serving different purposes. Our Cheyenne trust attorneys will know what would be best for you. Here is a list of a few types:

– Revocable Trust: This type of trust can be altered or revoked by the grantor during their lifetime. It’s often used for estate planning, as it allows the grantor to retain control over the assets and make changes as circumstances evolve.

– Irrevocable Trust: Once established, this type of trust cannot be modified or revoked. It is often used to remove assets from the grantor’s estate, providing protection from creditors and reducing estate taxes.

– Living Trust: Created during the grantor’s lifetime, a living trust allows for the seamless transfer of assets upon the grantor’s death without the need for probate.

– Testamentary Trust: Established through a will, this trust only comes into effect after the grantor’s death. It’s often used to manage assets for minor children or other beneficiaries who may need guidance in managing their inheritance.

How Does A Trust Help Protect Your Assets?

A trust can offer significant asset protection benefits. By placing assets in a trust, you can shield them from creditors, legal judgments, and potential disputes among heirs. For example, an irrevocable trust removes the assets from your estate, making them less accessible to creditors. This can be particularly useful for business owners or individuals in high-risk professions who may face liability issues.

What Are The Tax Advantages Of A Trust?

Trusts can provide considerable tax benefits. Depending on the type of trust, assets placed in the trust may be removed from your taxable estate, reducing estate taxes. Additionally, certain trusts, such as charitable trusts, can offer income tax deductions for the grantor. By working with a trust lawyer, you can explore the most tax-efficient strategies for your estate.

Can A Trust Help Avoid Probate?

Yes, one of the significant advantages of a trust is that it can help avoid probate. Probate is the legal process through which a deceased person’s estate is administered and distributed. It can be time-consuming, costly, and subject to public scrutiny. By placing assets in a trust, they can be transferred directly to beneficiaries without going through probate, ensuring a more private and efficient distribution.

What Should You Consider When Creating A Trust?

When creating a trust, it’s essential to consider your long-term goals and how you want your assets managed. You should think about who you want to appoint as trustee, what assets to include in the trust, and how you want the assets distributed. It’s also important to keep in mind that your trust can be tailored to meet your specific needs, so working with a knowledgeable trust lawyer is crucial to ensuring all your bases are covered.

Cheyenne Trust Glossary

If you’re looking for a trust lawyer in Cheyenne, Wyoming, understanding the basic terms and roles involved can help clarify the trust creation process and how it might fit into your estate planning needs. Below are some key terms to consider as you explore your options. At Davis & Johnson Law Office, we’re here to guide you through these decisions to help you make informed choices for your future.

Trustee

A trustee is the person or organization responsible for managing and overseeing the assets within a trust. Appointed by the grantor (the person creating the trust), the trustee’s main role is to carry out the terms of the trust in line with the grantor’s wishes. This means a trustee has both a legal and ethical duty to act in the best interests of the beneficiaries named in the trust. Managing assets responsibly, handling any distributions, and keeping accurate records are all part of the trustee’s obligations. Often, grantors may choose to act as their own trustee during their lifetime, while naming a successor trustee to take over when they pass. Trust administration is a serious role that requires integrity and financial prudence.

Revocable Trust

A revocable trust is a type of trust that the grantor can alter, change, or revoke at any time while they’re still alive. This flexibility allows individuals to make adjustments as their personal or financial situations evolve. Unlike an irrevocable trust, a revocable trust lets the grantor maintain control over the assets within it, which is why it’s commonly used in estate planning. After the grantor’s death, the revocable trust typically becomes irrevocable, and the trustee will distribute the assets according to the grantor’s instructions, often bypassing the probate process. This structure helps simplify the transfer of assets, ensuring beneficiaries receive what was intended for them in a more direct and efficient way.

Irrevocable Trust

An irrevocable trust is one that cannot be changed, modified, or revoked once it has been established, except under certain legal conditions. By placing assets in an irrevocable trust, the grantor effectively relinquishes ownership, which can offer certain protections and benefits. These trusts are often used for tax planning purposes and to safeguard assets from creditors, as assets placed in an irrevocable trust are generally considered separate from the grantor’s estate. Due to these benefits, irrevocable trusts are a common tool for individuals who want to protect their wealth and potentially reduce the taxable estate passed on to heirs. While they require more commitment, irrevocable trusts can be an effective choice for specific financial goals.

Fiduciary Duty

Fiduciary duty is a legal obligation that requires the trustee to act in the best interests of the trust’s beneficiaries. This duty involves a high level of care, loyalty, and impartiality, meaning that the trustee must prioritize the needs and interests of the beneficiaries over their own. Fiduciary duty includes managing trust assets responsibly, handling any distributions with fairness, and ensuring that all decisions reflect the intentions of the grantor. Fiduciary duty is fundamental to the role of a trustee and is legally enforceable, providing beneficiaries with the confidence that their interests are protected throughout the trust’s administration.

Probate

Probate is the legal process where a court oversees the validation of a will and the distribution of the deceased’s assets. One of the main benefits of creating a trust is that assets held within it can typically bypass probate. This can save time, reduce legal expenses, and maintain privacy for the family, as probate records are often public. Trusts help simplify the distribution of assets to beneficiaries, allowing them to avoid the delays and potential costs that can arise in probate. By setting up a trust, individuals can make asset transfer more straightforward and minimize the stress on loved ones during an already difficult time.

Setting up a trust can help secure your family’s future and offer valuable protections for your assets. For help creating a plan that aligns with your goals, contact Davis & Johnson Law Office today and schedule a consultation with our legal team. Let’s work together to create a trust that fits your unique needs.

Davis & Johnson Law Office, Cheyenne Trust Lawyer

1807 Capitol Ave Suite 200, Cheyenne, Wyoming 82001

Read more of our Google reviews and let us know how we can help with your legal issue.

Contact Our Cheyenne Trust Lawyer Today

Creating a trust is a significant step in securing your financial future and ensuring your loved ones are cared for according to your wishes. Whether you’re looking to protect your assets, avoid probate, or provide for your family in a specific way, a trust can offer the control and peace of mind you need. Contact Davis & Johnson Law Office today to discuss how we can help you create a trust tailored to your unique needs. Let us guide you through the process and help you take the next step toward protecting your legacy.

Client Review

“I cannot express how fortunate I was to have found this Law Office and Have Jason Represent me in a year long work comp proceeding,Jason and his team were patient with me and answered all my questions,they have good values and are there for you and will work hard to get the job done.”

Brenda van orden